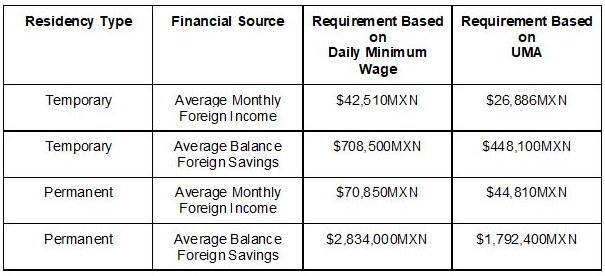

2021 Financial Requirements for Temporary and Permanent Residency in Mexico

Each year, Mexico increases the financial requirements to obtain either temporary or permanent residency. We have outlined the most commonly asked about residency types and this year’s financial requirements.

How is the requirement calculated?

There are two different ways that Mexican Consulates and Mexican Immigration offices may determine the financial requirements for residency. Note: Each consulate and office are different. Before you schedule your appointment with your local Mexican Consulate, you should always check the requirements on their website.

✓ Based on the Mexican daily minimum wage ($141.70MXN).

OR

✓ Based on the daily UMA (Unidad de Medida y Actualización) rate ($89.62MXN).

-

- UMA is the basis for all calculations in Mexico that relate to payments made to the Mexican Government. It is used in calculations such as residency, employer contributions to social security, and other federal and state obligations.

Temporary residency with foreign income = 300 X daily minimum wage or UMA.

Temporary residency with savings balance = 500 X daily minimum wage or UMA.

Permanent residency with foreign income = 5000 X daily minimum wage or UMA.

Permanent residency with foreign income = 20000 X daily minimum wage or UMA.

What Proof is Required?

Depending on the Mexican Consulate you begin your process with outside of Mexico and the immigration office within Mexico, you will be required to show:

✓ Foreign Income: 6 to 12 months of bank statements proving the average monthly income requirement.

✓ Foreign Savings: 12 months of bank/investment statements proving the average monthly balance requirement.

The Mexican immigration process can be challenging and stressful. Let our immigration specialists help make the process faster and easier. Contact our Mexican immigration specialists at Mexlaw today!